Choosing V.I.P Mortgage

How We're Different

Unlike traditional organizational hierarchy where authority and decision-making power are at the top of the pyramid, VIP’s Lead Up approach places customers at the top and focuses on ‘leading up’ through the organization to empower employees to engage, problem solve, and lead.

We realize the most important element in customer service is whether the borrower would work with us again and recommend us to others. VIP makes this our number one priority in business; building relationships for life!

Smooth Transition

Products & Programs

Advanced Technology

VIP wants to make sure that new loan originators don’t miss a beat when they come on board. Therefore, you can expect a comprehensive, detailed, and effective on boarding process from day one. From computer and phone set-up to database transfer, our team of mortgage support professionals ensures that you have everything you need to get going.

VIP offers a wide-ranging library of products and programs to fit the needs of almost all borrowers. FHA, Conventional, VA, Construction and Down Payment Assistance are just some of the programs that provide you with the opportunity to match your clients with the best possible option for each of their unique financial situations.

With the importance of technology directly tied to the success of a business, VIP has invested and continues to invest in their technology platforms. The technology that is provided helps loan originators to grow their business, stay in front of past, present, and future clients, supports and fosters relationships, and makes the loan process smooth and painless for both borrowers and employees.

Marketing

Close On Time

Training & Development

VIP wants to “win” with their loan originators and provide them with the tools they need to thrive. Marketing is an important component to the overall success of a loan originator. From our state-of-the-art SPEAR CRM, automated campaigns, video, landing pages, single property websites, open house flyers, joint social media campaigns to custom graphic design, there isn’t one aspect of marketing VIP hasn’t thought of.

Closing on time isn’t just something that VIP says, it’s something that we do. With the correct processes and systems in place, loan originators are empowered to close more loans quickly and with less work. Our in-house Underwriters work closely with our loan originators to help avoid roadblocks, and to get your buyers to fund on time.

If you’re looking for a career and not just a job, VIP provides both the training and career development you need to build your business and be successful! Our robust training department offers weekly training sessions, on-call trainers, a Loan Originator Advisory Board and an optional enhanced one-on-one coaching program.

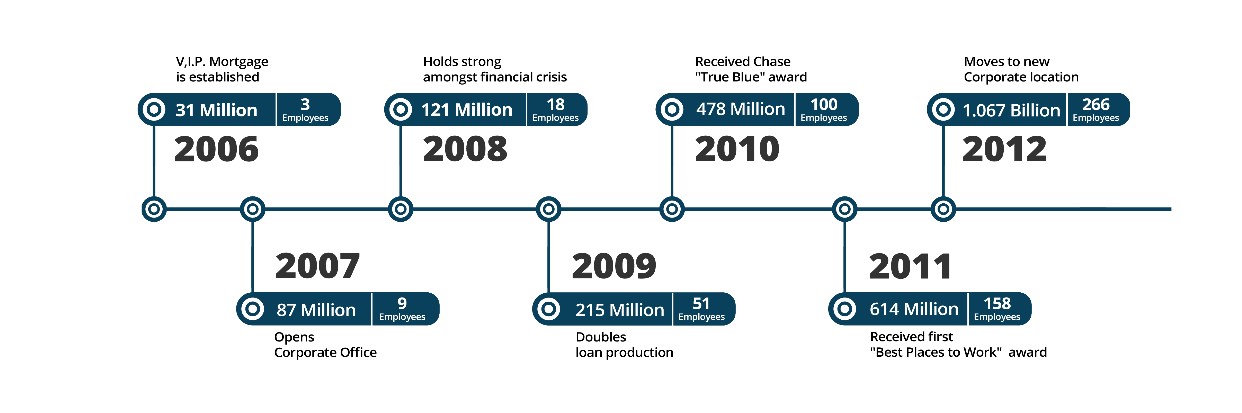

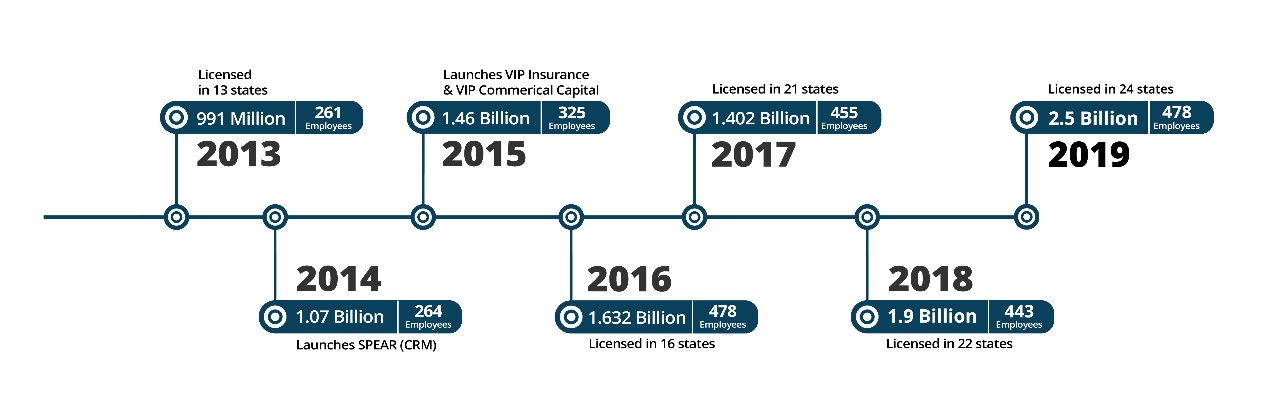

Our Growth

Products and Programs

VIP provides loan originators with a broad range of mortgage product offerings and flexibility. Loan originators are free to use the in-house underwriting for Conventional, Jumbo, or Government programs. For unique situations, VIP offers products through several portfolio lenders.

VIP has agency/seller relationships with Fannie Mae, Ginnie Mae, and Freddie

Mac, providing loan originators with competitive pricing on conforming products. The experienced product team ensures that all new products are fully vetted before adding them to the product library and that loan originators have access to all necessary materials to remain educated and informed.

Loan Options:

- FHA

- VA

- USDA

- HUD - 184

- Manufactured Homes

- HomeStyle Renovation

- 203K

- Reverse

Specialty products:

- High LTV Jumbo

- Non QM Jumbo

- Foreign National

- Bank Statements/Tax Return Qualifying

- Multiple Investment Properties (exceeding Fannie limits)

- Asset Depletion

- Non-Warrantable Condos

- Stand-alone 2nd Mortgages

- Construction Loans

- Commercial Properties

Compensation & Benefits

As a highly regarded and awarded mortgage company, VIP offers a compelling compensation package, with a bonus and incentive package to tenured and experienced loan originators. You also have access to a benefits program that includes:

Health Insurance, Dental Insurance , Vision Insurance, Life Insurance,

Retirement Benefits, Disability Benefits, 401K Options, and Paid Community Service.

More than just offering the typical benefits, VIP steps it up and offers some unique benefits that help create the culture we love:

On-site staff masseuse at our Corporate office and other branches, a gourmet coffee bar, paid community service days to support those causes closest to your heart, holiday events and family activities, and community service and volunteer projects.

President’s Club

A goal that all loan originators hope to achieve yearly is qualifying for the President’s Club. In order to achieve the President’s Club designation, loan originators must qualify in one of the below categories:

• Have at least $30,000,000 in volume

• At least 120 purchase units

• At least 180 total units

All members of the President’s Club, and a guest, are treated to a luxury vacation where they have the opportunity to share experiences with other top performing loan originators and Executives! And, have some fun while doing it.

featured trip